Share this

Social Insights Reveal Dramatic Shifts in Automotive Consumer Trends

by Infegy Research Team on January 20, 2020

The way people think about cars and the process of buying cars has changed. From electric vehicles to online car buying (and car delivery!) there has been a drastic shift in the car buying experience-- including the question of whether people will buy cars at all.

But what's driving (pun intended 🚙) auto industry trends, and what do people think about their car buying experiences? What do consumers look for when buying a car? Which auto brands are keeping up? Our latest social insights report reveals three main drivers: costs, innovation/technology, and the environment.

Here are the biggest takeaways from our social listening report on the auto industry:

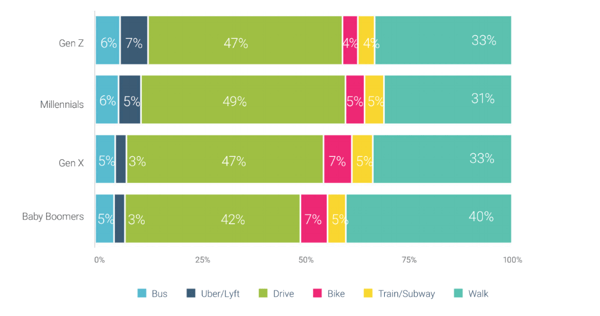

Gen Z and Millennials Discuss Alternative Ways of Getting to Work

Consumers talk about driving to work the most, but that declines with consumer age.

Our research shows that the two youngest groups, Millennials and Gen Z, turn to alternative methods of traveling to their jobs: taking the bus or rideshare apps like Uber and Lyft. 15-20% of consumers in this group take public transit or rideshare.

Another thing for auto brands to pay attention to: the second leading mode of commute is walking to work. With the trend for younger generations to live downtown, we anticipate seeing numbers continue to grow for alternative methods of transportation.

This suggests that, at a growing rate, consumers are considering not driving cars, signaling that younger groups may not be looking to own vehicles in the near future.

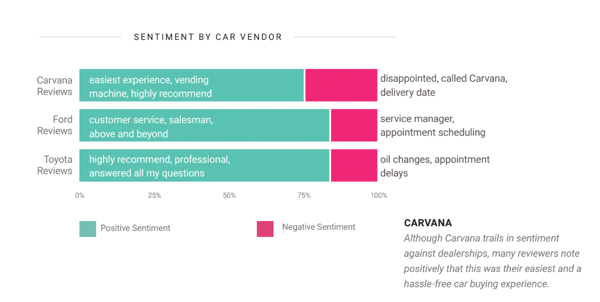

Google Reviews Analysis Shows Dealerships Edge Carvana

Carvana and similar services have appeared to upend the consumer car buying experience. You can now get a car delivered to your doorstep with a few clicks on your phone.

However, social listening analysis of consumer conversations across Google Reviews shows consumers still prefer the dealership experience. Here's the insight from our report:

Here, data from Carvana reviews is compared to the reviews for Ford and Toyota dealerships. Audiences for both have positive experiences, but sentiment analysis of consumer reviews shows that the dealerships beat Carvana, both with 85% positive sentiment across the online reviews.

The leading keywords for these consumer reviews focus on customer service, professionalism and “above and “beyond” treatment from sales people. Carvana received positive comments regarding convenience and speed, but themes around service were negatively discussed.

While online car shopping might be the new norm, it could be the dealerships that are more likely to drive the final purchase (and leave customers more satisfied).

Meanwhile, Carvana has made the process of buying a car easier, but disappointment from some consumers at the final result shows dealerships will continue to drive high value for auto manufacturers.

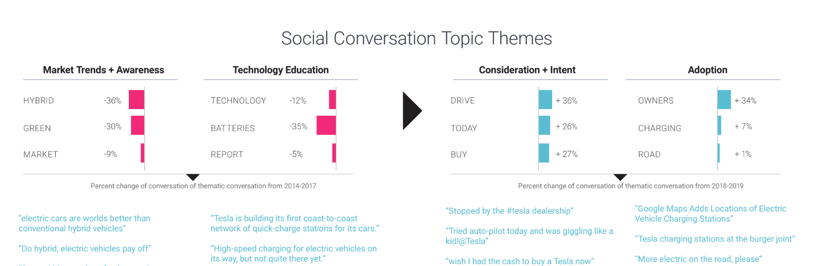

For Electric Vehicles, Consumers Shift From Awareness+Education to Consideration+Adoption

Using social listening, you can follow topical themes over chosen periods of time to track trends and changes regarding those themes.

Here we looked at how consumers talked about electric vehicles surrounding the widely accepted need to reduce personal carbon emissions.

The data shows that from 2014-2017, topics signaling consumer education and awareness drove consumer conversations around electric vehicles. But from 2018 forward the leading conversational themes shows consumers have moved on to consideration and/or adoption of EVs and their technology.

The leading terms from 2014-2017 like “hybrid”, “green” or “batteries” have seen a 17-25% decrease in mentions over the past two years. Meanwhile, consumers discuss driving, charging, buying and owning electric vehicles at an increasing rate since 2018.

This underscores how consumers are shifting their mindset around electric vehicles.

No longer is learning about the problems and possible automotive solutions to the environmental factor the driving force behind consumer behavior. Now, people talk about them from an active standpoint.

Auto dealers who are launching new EV vehicles in the market can now more easily target consumers who have moved through the education funnel by tailoring their messaging.

Auto makers should understand that consumers have shifted how they think about the environment and electric vehicles, and this is causing changes in how they consider, adopt… and buy.

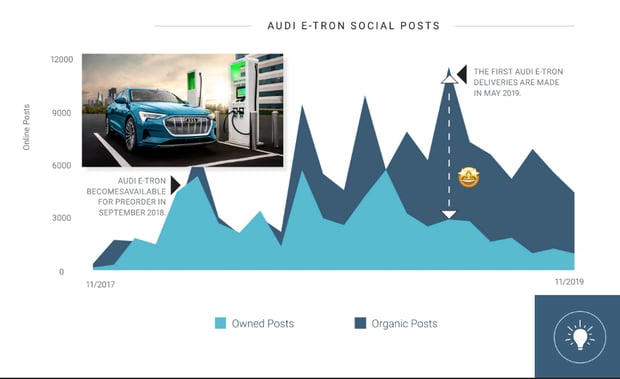

Audi Generated Organic Buzz for the Launch of their Electric Vehicle

As car makers recognize the need to develop electric vehicle options to compete with all-electric brands like, how can they see if these product launches are successful?

When you launch a major product, it’s important to be able to analyze how word spreads and if the launch generated buzz from consumers.

Inside the auto industry social insights report, you’ll see how a major brand, Audi, was able to drum up enthusiasm for the launch of their all-electric E-Tron vehicle:

This chart shows the amount of conversations about the E-Tron on both Audi’s own channels and organically. Comparing the two, you see how many more conversations happened outside of Audi’s own content and that conversation sustained well after Audi’s owned engagement trailed off.

One challenge brands face when analyzing social activations is finding insights about online audiences that aren’t connected to their owned channels.

Any typical social analytics platform can tell you how much engagement your owned content did, but what do consumers say about you unsolicited elsewhere on the web?

Here you see how Audi successfully generated organic buzz around the launch of their vehicle with 301% more conversations about the E-Tron that were not related to Audi’s owned content.

This proves Audi created organic buzz about their new vehicle, showing how far their launch reached and got people talking across the web.

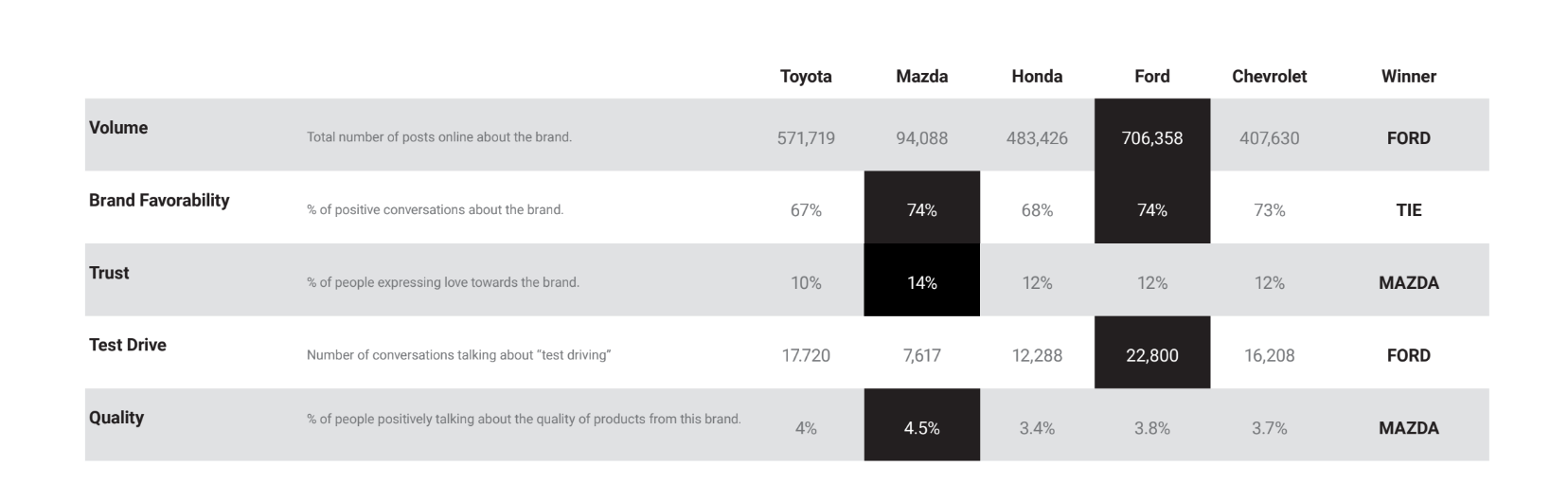

Mazda Leads Auto Brands in Positive Sentiment and Emotions, Ford wins out for Test Drives

Which automakers win out in areas of consumer sentiment, trust, intent? Which brands do consumers express emotions like joy towards? And which car brands do they want to test drive?

Using social listening insights provided by Infegy Atlas, you can cross compare the leading auto brands to see which brands win these crucial metrics.

We analyzed the social web to see which brands won in those metrics. Here’s what the data says:

Ford is the most discussed auto brand online. But it’s Mazda that takes home the cake for key metrics such as positive sentiment, intent, quality, trust and joy emotions expressed by online voices.

However, Ford beat out all competitors in our custom-built metric for consumers mentioning they planned to or did test drive.

Conclusion

Automotive audiences are made up of consumers with different needs and experiences: some aim to reduce their spend on cars, some use other forms of transportation, and many want to reduce their carbon footprint by going electric. Classic car groups- from sports cars to mini-vans- remain. But who buys them, why and how is changing.

It’s important for auto brands and agencies to listen in to the consumer conversation and use advanced data on how consumers identify and what they discuss to hone in on what’s driving their preferences.

As the car shopping, buying and owning experiences evolve for consumers everywhere, car brand teams can’t afford to miss out on this data. Social listening with Infegy Atlas is your best option to find it.

get in touch with our team today for more info on how we gathered these insights and how they can help your team’s efforts!

Share this

- April 2024 (2)

- March 2024 (3)

- February 2024 (3)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (3)

- September 2023 (3)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (4)

- April 2023 (4)

- March 2023 (4)

- February 2023 (4)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (3)

- September 2022 (3)

- August 2022 (2)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (2)

- November 2020 (1)

- October 2020 (2)

- September 2020 (1)

- August 2020 (2)

- July 2020 (2)

- June 2020 (2)

- April 2020 (1)

- March 2020 (2)

- February 2020 (2)

- January 2020 (2)

- December 2019 (2)

- November 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (2)

- July 2019 (2)

- June 2019 (1)

- May 2019 (2)

- April 2019 (1)

- March 2019 (2)

- February 2019 (2)

- January 2019 (1)